Good bookkeeping: how to record receipts of transactions

Receipts provide proof that the goods or services you provide have been exchanged for money. Without receipts, you run the risk of the buyer, seller, and your business being unable to prove that a transaction took place. Individuals should keep receipts and other records for three years after filing taxes.

How to manage receipts and purchase invoices

Classes include broad categories such as cash and cash equivalents, equities, commodities, real estate, and intellectual property, among others. Beyond basic accounting terms, this resource also explains alternative word uses and defines related or adjacent concepts. Importantly, it also covers relevant etymologies and word histories in cases where knowledge of these elements can help you better understand the term.

Who Creates a Receipt?

Income statements are one of three standard financial statements issued by businesses. It is a more complete and accurate alternative to single-entry accounting, which records transactions only once. Small business owners and individual taxpayers can also benefit from a strong working knowledge of basic accounting concepts and terms. Accounting advances financial literacy and yields precise, powerful insights into financial health.

Everything You Need to Know About Sales Receipts

A gift receipt contains some details of the sale, but almost always leaves out price information. That way, the recipient can exchange the item without seeing the sale price. Some gift receipts include the name of the item; others simply include a barcode that allows the business to access the sale record. If you issue gift receipts, you must decide whether or not the receipt is acceptable for returns, or if it can only be used for exchanges. Your accounting books’ accuracy is ensured by such supporting documentation.

Caribbean Development Bank (CDB) Definition

Beyond that, several niche industries have their own special receipt types. Occasionally, retail stores issue invoices to customers who have credit accounts; this enables the customer to get the product first and pay later. While most receipts include a standard set of information, gift receipts are an exception to the rule.

- The CRA has this rule because if your company is audited, tax officials need to be able to inspect the original file using their own systems.

- Accounting involves recording, classifying, organizing, and documenting financial transactions and data for internal tracking and reporting purposes.

- You can find many more informative articles on the QuickBooks Resource Centre.

- Keep records like invoices, receipts, and canceled checks that show who you bought from, how much you paid, and what you bought.

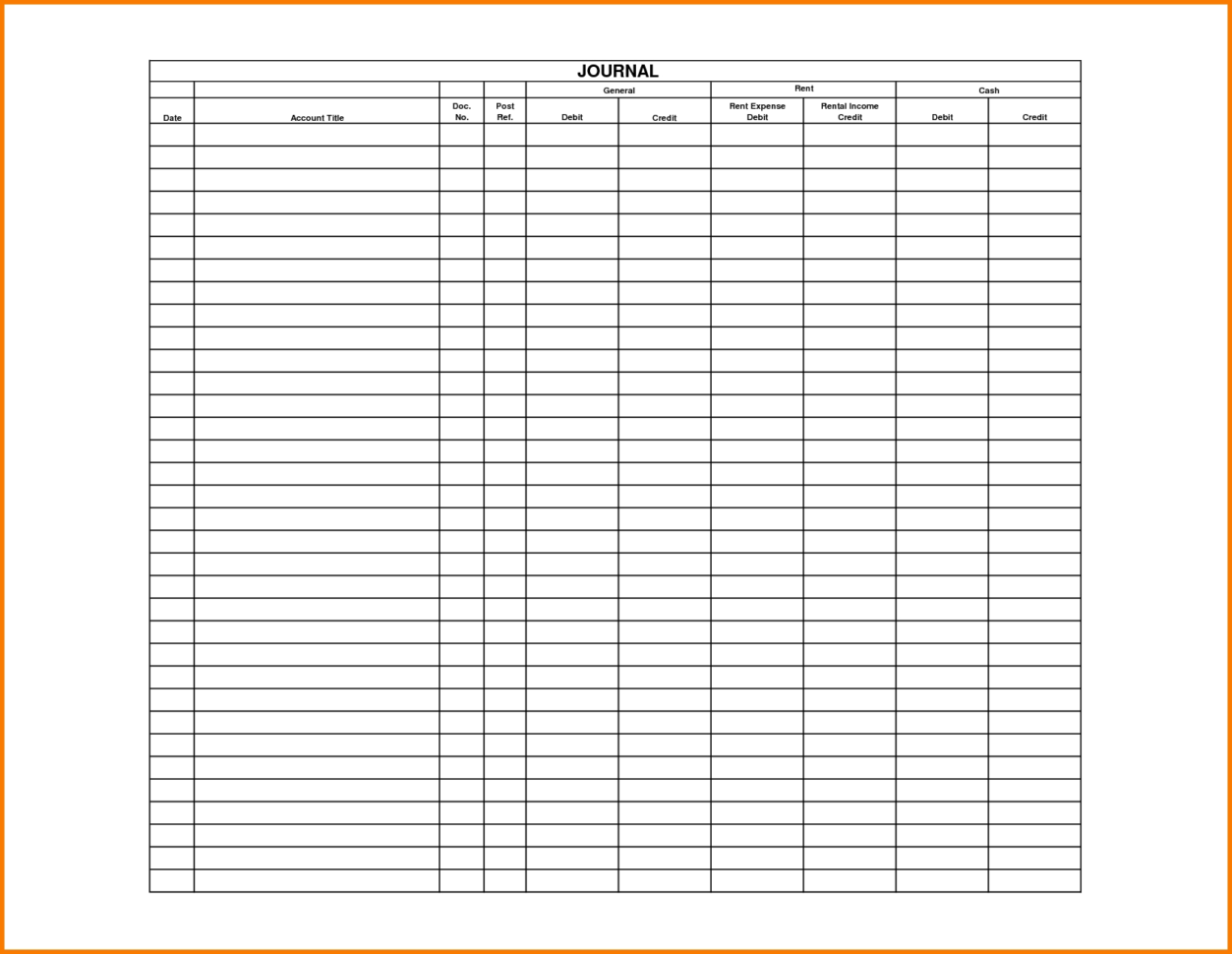

This order is not sent directly to the bank but remains with the payee, who may receive the amount due upon presentation of the original receipt. After withdrawing money from the account, the receipt is returned to the payer. In a receipts and payments account, there is a receipts column on the debit side. All payments are entered on the credit side under headings such as salaries and wages, printing and stationery, office expenses, and rent, rates, and taxes.

This simple, intuitive feature also allows you to customize the receipt to fit your company’s goods or services. Instead of registering the sale as income, most companies treat invoices as accounts receivable. Only when the payment is completed can the amount be recorded as income and deposited in the bank. Receipts are provided only after receipt in accounting the goods have been transferred or the services have been rendered, and the customer has paid in full. This can happen when a customer is paying for a high-priced item in installments, or when a continuous service is delivered and paid for on a recurring basis. When this happens, the receipt usually indicates the remaining balance.

Receipts should contain all relevant details and be retained as part of the financial records for future reference and auditing purposes. A sales receipt acts as a record of a transaction for both a seller and a buyer. A seller will issue a receipt when a sale is made to verify the amount paid by the buyer for the provided product or service. The practice of retaining receipts for tax purposes is thought to originate from ancient Egypt. Farmers and merchants sought ways to document transactions to avoid tax exploitation.

This can be especially useful for businesses that want to create a professional-looking receipt without the need for extensive design skills or experience. Organizing your documents and references concerns everything surrounding the production, retention, and use of receipts. Add a Pay Now button to your invoices and let customers pay online 4x faster than with paper invoices. Since receipts indicate proof of purchase, businesses can use them to verify a transaction in case there’s a problem with the purchase, and it needs to be refunded. A record of past business expenses can also help companies plan for the future and create budgets based on past expenses.

The term may also refer to the state or act of receiving goods or money. If I say “We will deliver the goods on receipt of payment,” it means we will deliver the goods after we have received payment. There are software programs available that can read receipts and extract data from them automatically. These software programs are commonly referred to as receipt scanners or receipt readers. While these documents have some similarities, they’re used for different purposes. This quick guide will help answer your questions about the differences between an invoice vs. receipt so you can use them appropriately within your business.

– 455

– 455 50 Rodadas Grátis

50 Rodadas Grátis